Greater Bay Area to welcome more financial openings in China

The guideline support for further financial openings in the Greater Bay Area brings new growth opportunities to office demand in Guangzhou and Shenzhen market.

China announced new policies and pilot programs to promote financial opening and integration of the Guangzhou- Hong Kong-Macao Greater Bay Area (GBA) on May 14th. The People's Bank of China and regulators of the banking, insurance, securities and forex sectors jointly issued 26 new measures to guide financial reforms and provide direction to financial openings in the GBA.

Measures that promote cross-border finance, in areas such as wealth management, private equity, foreign exchange, will boost cross-border trade and investment. For example, there are pilot schemes that allow institutional investors in Hong Kong and Macao to participate in private equity and venture capital funds in the GBA. Funds will be set up for key projects in the GBA, allowing capital from insurance firms and bank's wealth management units in mainland China and the two special administrative regions to participate.

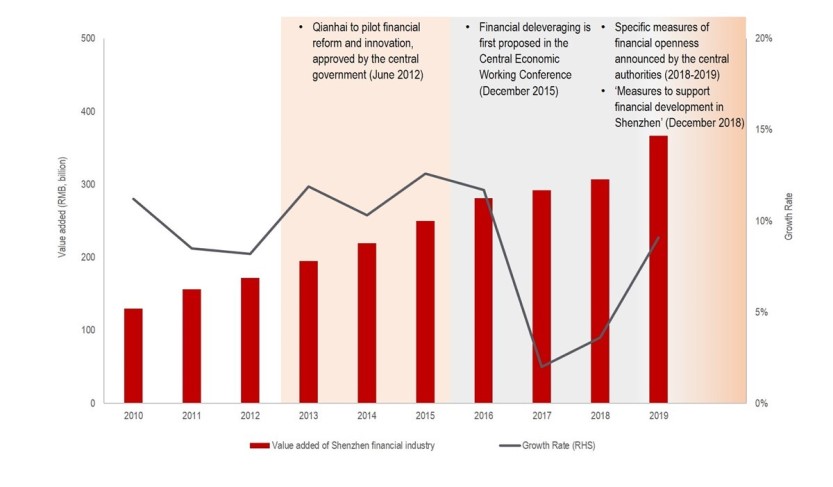

Meanwhile, steps will be taken to promote financial cooperation in the banking, securities and insurance sectors, as well as to integrate the financial infrastructure in the GBA, such as the application of blockchain, big data and AI. The example of Shenzhen, a major economic centre in the GBA, show that the release of major financial polices often had a pivotal impact on the growth of the financial industry.

Figure 1: Major financial policies impacting the growth of Shenzhen’s financial industry

Leasing demand in the financial sector may grow in Guangzhou and Shenzhen office market

The implementation of the guidelines will greatly facilitate cross-border businesses and improve the accessibility of the mainland’s financial market. It will bring in more businesses for both mainland and Hong Kong and Macau financial institutions, as well as create new growth opportunities for office demand in Guangzhou and Shenzhen markets.

Figure 2: The average office area of different sectors in the financial industry in Grade A buildings

Source: JLL Research

Institutions in banking, securities and insurance sectors have relatively large footprint in the office lease markets in Guangzhou and Shenzhen. In Shenzhen in particular, an average office occupier in any of these three sectors occupy space that exceeds 2,000 sqm. On the contrary, the average size of foreign-funded financial institutions in the GBA is relatively small at present. However, with further opening up of the financial industry, the sizes of institutions in some sectors are expected to grow. Based on the above market analysis, we believe that:

- The opening up of banking, securities and insurance sectors will attract relevant financial institutions in Hong Kong and Macau to set up new offices in mainland cities in the GBA, especially Shenzhen and Guangzhou.

- Many banks in Shenzhen and Guangzhou will expand their office space to meet the requirements of new business development such as cross-border wealth management and cross-border loan business.

- The pilot of cross-border private equity investment funds will prompt the establishment of more such institutions, as well as encourage Hong Kong and Macau based ones to set up new offices in mainland cities.

- With the maturity and development of fintech-related applications, the business of companies in the fields of blockchain, big data and AI, will grow steadily, with an active expansion demand.