After a strong 2018, more hospitality M&A are expected this year

However, the focus will shift to smaller, niche platforms in 2019

After a bumper 2018, more hotel mergers and acquisitions are expected this year. But don’t expect a further slew of mega transactions. The focus instead is shifting towards more private deals with smaller platforms.

The top hospitality brands only account for around a third of hotel rooms around the world, making more acquisitions in 2019 likely, says Tony Ryan, Managing Director of Global Mergers & Acquisitions in JLL’s Hotels & Hospitality Group.

“Most of the larger platform deals have already been done, so the big operators are now seeking out unique concepts and locations to complement existing product offerings – particularly as consumer demand changes. Those transactions will occur primarily in Europe and Asia, where there is greater opportunity for consolidation.”

On the revenue side, having a global reach enables hotel groups to provide customers with the type of accommodations they want, where they want it.

The purchasing power of a bigger operation can also mean significant cost savings, says Ryan. “Bigger players have more buying power than a standalone hotel, and so are able to pay lower commissions to distributors such as Expedia or Booking.com.”

Targeting smaller platforms

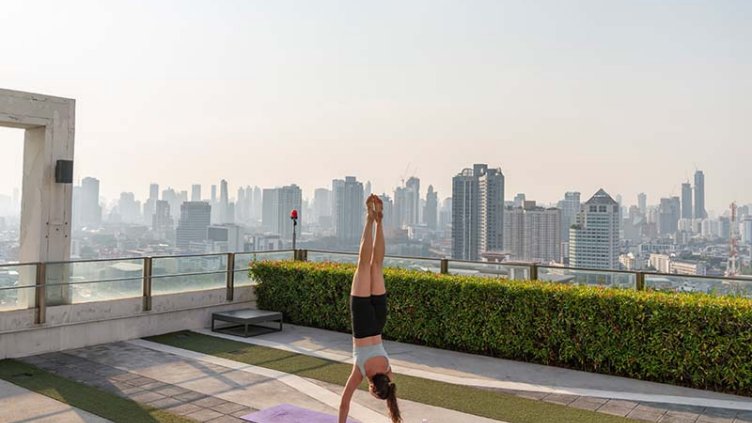

With aggregation among the industry’s big guns more or less complete, the major global brands are turning their attention to smaller, niche players that can help them build out a full presence in every part of the accommodation market both geographically and by sector – in particular luxury, wellness, lifestyle, and entertainment.

All the major brands are seeking to enhance their luxury offering, says Ryan. “That has a halo effect on the rest of the company. Given the room rates that luxury properties achieve, it can also be highly lucrative.”

Examples include AccorHotel’s acquisition of FRHI Holdings (parent of the Fairmont, Raffles and Swissôtel brands), IHG’s purchase of Regent Hotels, and more recently, Hyatt’s acquisition of Alila Resorts through Two Roads Hospitality.

Another is LVMH’s recently-announced agreement to acquire Belmond – at a significant premium to its share price. “LVMH has an outstanding market share in luxury goods, and it wants to offer its clients luxury travel experiences,” notes Ryan.

“High-end customers are increasingly seeking transformative experiences and wellness-inspired retreats,” says Ryan. He cites Hyatt’s 2017 acquisition of Miraval and IHG’s recent acquisition of Six Senses Resorts as evidence of these companies’ ability to respond to a growing demographic of discerning travellers.

Acquisition sights have also centred on some of the more millennial-focused and urban-oriented lifestyle brands. These brands have elements of neighbourhood authenticity, entertainment and out-of-the-box F&B concepts, says Ryan. Accor’s investment into 25Hours and SBE Entertainment are prime examples.

Other potential players

Traditional capital providers, such as private equity players and even some sovereign wealth funds, could further drive up M&A activity levels going forward, says Ryan.

In a bid to deploy capital more effectively in a time of lower yields, a growing number of investors are looking to broaden their hospitality strategy into operating platforms, leveraging on their experience and expertise as owners.

“Rather than just buy an individual asset and have someone else manage it, acquiring an existing operating platform allows these investors to scale the business by adding new assets and develop the management business. That way they can both enhance the performance of the assets and create a management company as another vehicle of value to sell down the track.”

Brookfield, Queensgate Investments and KSL Capital have all pursued this strategy in recent years, and more private equity investors are likely to follow, Ryan expects.